VIDEO: Rare Look Inside Bank Gold Vault

How did JPMorgan Top the Gold Market with a Record $1 Billion in Income?

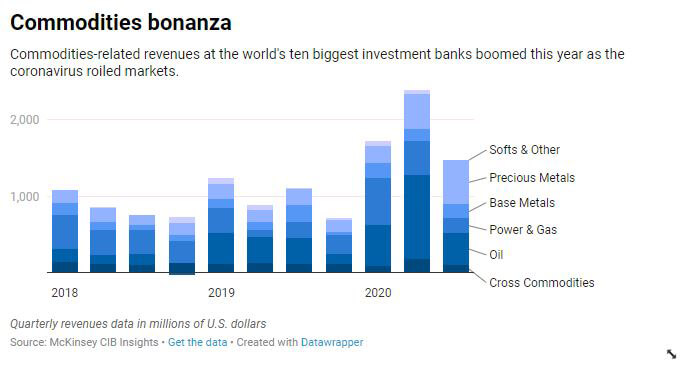

COVID has been a win-fall for investment banks managing gold, silver and other valuable metals by setting off enormous financial backer buys and breaking the typical functions of the market.

However, JPMorgan has been growing its share in the gold market.

The U.S. bank’s income by mid-November represents half of the $1.7 billion to $2 billion that consultancy McKinsey CIB Insights gauges the top 10 investment banks together will make this year from precious metals, mostly in gold.

Its commodities division is on target to earn more than $1.5 billion this year and could challenge Goldman Sachs for the title of top earner, the sources said.

Goldman Sachs and JPMorgan… no comment.

In he past, investment banks have made less than $1 billion in commodities, and none has ever before made more than around $600 million in precious metals in one year, according to George Kuznetsov at McKinsey CIB Insights.

JPMorgan is the single largest bank in the United States and one of the biggest on the planet.

It sits at the core of the worldwide bullion market, and it is involved in trading physical bars to derivatives, running vaults and trades in London, the largest exchange center.

A Revenue Bonanza

Profit has been driven by investor demand for gold and silver, chiefly in Europe and North America, stressed the COVID Pandemic and cash printing by national banks could devalue other assests.

Investment in gold has recently pushed gold prices record highs above $2,000 an ounce.

Profits from the Comex futures exchange in New York, saw supply gives issues making it fruitful for those trading gold and precious metals.

Banks, including JPMorgan made the most of these opportunites on Comex and assisted customers with doing likewise.

JPMorgan’s customer business is far and above that of other banks.

Information from CME Group, which runs Comex, shows JPMorgan’s customers represented 33% of all exchange in gold bars registered with the excahnge in October, and over two fifths in June.

Like other large banks, JPMorgan was able to ship and deliver metals efficiently and in huge amounts when other, samll traders were unable to do so, according to sources.

The increase revenue from gold will likey moderate some, yet high gold prices and interest from investors means this business will remain profitable for the foreseeable future.

info courtesy of Reuters News