Gold Above $1800, response to inflationary pressures?

Gold Prices have Surpassed the $1800 an Ounce Level

Now Above $1800 an Ounce. Gold prices rose and surpassed the $1,800 level on October 18th. Investors continue to assess the Federal Reserve’s likely response to inflationary pressures. The Fed chair said last week that inflation “could last longer than expected.”

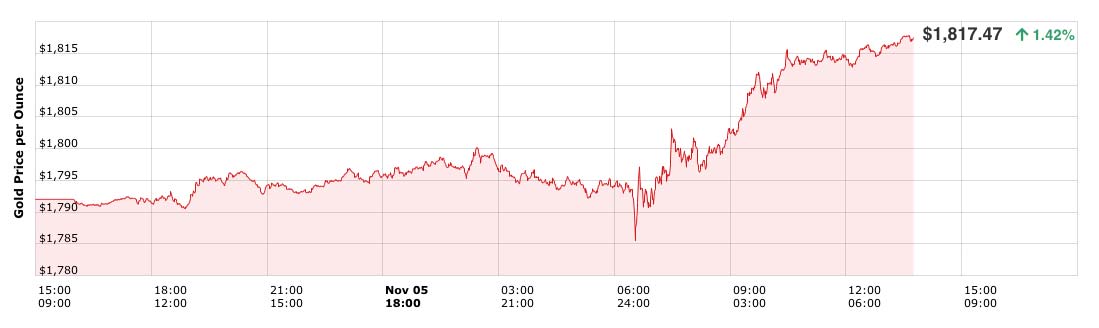

Spot gold also gained 1.42% by 4:00 pm EDT on November 5th to trade at $1,817.47/oz. This is the highest it’s been in over a month. US gold futures also rose $0.7% to $1,818.60/oz in New York.

Gold’s rise above $1,800 comes on the back of last week’s rally, which saw the metal at one point hitting its highest levels since early September after Fed chair Jerome Powell said the US central bank should start reducing its asset purchases.

Powell, however, added that talks of raising the short-term interest rate are “premature” as of now.

Gold is often considered an inflation hedge, but reduced stimulus and interest rate hikes tend to push government bond yields up, translating into a higher opportunity cost for the non-yielding bullion.

“There is some short-term momentum building in gold as some investors look for an inflation hedge and see gold as a potentially provider of that,”

IG markets analyst Kyle Rodda told Reuters, adding that $1,830 is a key resistance level if gold breaks above $1,800.

In the long term, however, Rodda said gold’s trajectory hinged mainly on how aggressive central banks would act to contain inflation.

In a Bloomberg article last week, mining industry veterans David Garofalo and Rob McEwen predicted that investors will catch on soon that global inflationary pressures are less transitory and more intense than central bankers and consumers price indexes suggest.

As such, gold’s inflation-protection appeal probably will send prices to $3,000/oz when that realization sets in, the former Goldcorp executives said.

Higher readings of inflation set to be a “boon” for gold

Gold could test new highs again this year, according to David Lennox of Fat Prophets, who said he sees “a fairly big tick” ahead for prices of the precious metal.

“Inflation’s coming back because we’ve seen such a significant surge in U.S. money supply,” he explained. “Whenever we’ve seen that surge in the past, it’s been accompanied — probably five of six months later — by higher inflation.”